How will participants benefit after this workshop?

The purpose of this program is to provide the participants full understanding regarding the features of the new VAT law. Another purpose is to make them understand the features of the automated system through which the new VAT law has been implemented. In addition, providing working knowledge regarding the provisions of the current VDS system is also a purpose of this training. Thus, attending the program, the participants:

— Can develop knowledge regarding the full features of the new VAT Act & Rules;

— Can understand the full features of the automated system through which the new VAT law & Customs law has been implemented;

— Can understand their role to implement the new VAT law;

— Can understand the full provisions of current VDS system;

— Can plan strategies for their organizations ahead to face future challenges;

— Can plan strategies for their organizations ahead to reap the benefits of the provisions of the new VAT law;

— Can further develop their career in VAT, customs, finance and management.

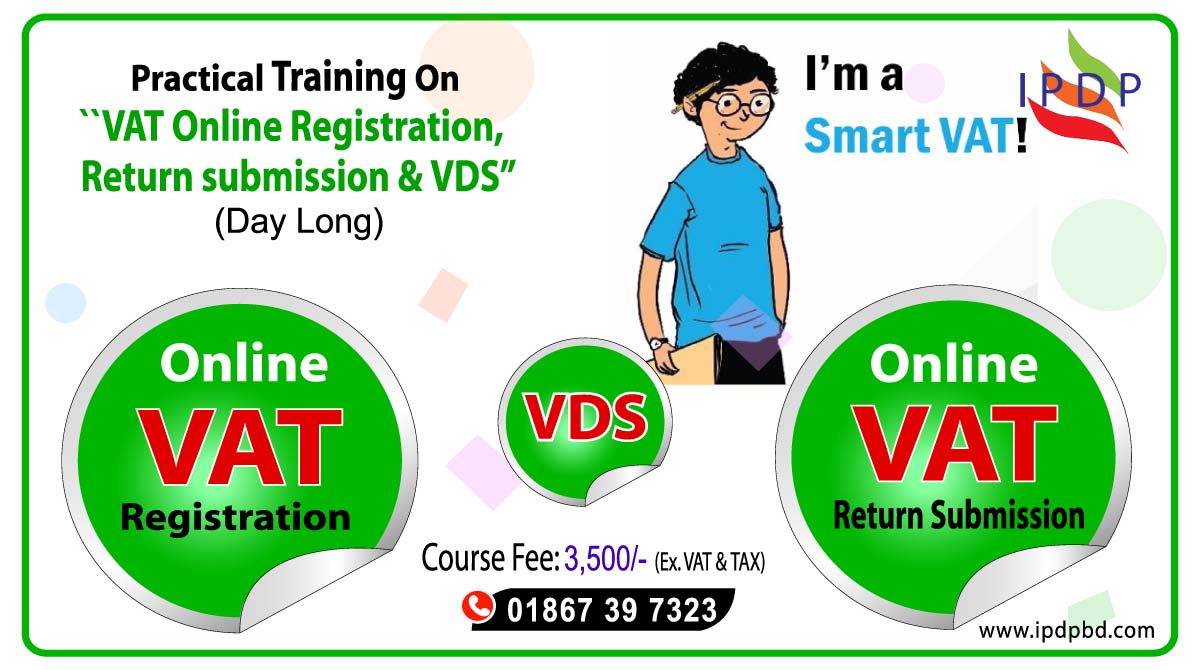

Contents of workshop:

Online VAT Registration (Mushok 2.1); Subjects include:

– Trader / Businessmen

– Commercial Importer / Commercial Importer

– Supplier / Procurement Provider

– Contractor

– Manufacturer

– Central Registration

– Unit Registration

Online VAT Return Submission (Rule 9.1); Subjects include:

– Trader / Businessmen

– Commercial Importer / Commercial Importer

– Supplier / Procurement Provider

– Contractor

– Manufacturer

VAT Deduction at Source (VDS); Subjects that remain:

– VAT deduction on goods and services

– Rate of VAT deduction on goods and services

– Rules for deduction at source

– Entities deducting VAT at source and their responsibilities

– Time of Deduction and Method of Payment